The Digital Divide: Blockchain Cryptocurrency vs. Government-Controlled Currency

The advent of digital currencies has ushered in a new era of financial transactions, challenging traditional banking systems and monetary policies. At the forefront of this revolution are two distinct approaches: blockchain-based cryptocurrencies and government-controlled digital currencies. Each approach presents unique advantages and drawbacks, sparking intense debate among policymakers, economists, and technologists.

Blockchain Cryptocurrencies: A Decentralized Revolution

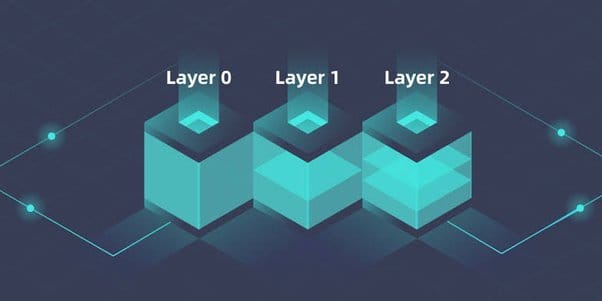

Blockchain cryptocurrencies, such as Bitcoin and Ethereum, are built on a decentralized network of computers. This distributed ledger technology ensures transparency, security, and immutability. Transactions are verified by a network of nodes, eliminating the need for intermediaries like banks.

Key Advantages of Blockchain Cryptocurrencies:

- Decentralization: Blockchain cryptocurrencies are not controlled by any single entity, making them resistant to censorship and government interference.

- Security: The cryptographic algorithms used in blockchain technology make it difficult for hackers to manipulate or counterfeit transactions.

- Transparency: All transactions on a blockchain network are publicly visible, fostering trust and accountability.

- Financial Inclusion: Blockchain can provide access to financial services for individuals and businesses in underserved regions.

Challenges and Limitations:

- Volatility: The value of blockchain cryptocurrencies can fluctuate significantly, making them risky investments.

- Scalability: As the number of transactions on a blockchain network increases, it can become slower and more expensive.

- Regulatory Uncertainty: The lack of clear regulatory frameworks for blockchain cryptocurrencies can create legal and compliance challenges.

- Energy Consumption: The process of mining cryptocurrencies can be energy-intensive, contributing to environmental concerns.

Government-Controlled Digital Currencies: A Centralized Approach

Government-controlled digital currencies, also known as Central Bank Digital Currencies (CBDCs), are issued and regulated by central banks. These currencies are designed to complement or replace traditional fiat currencies.

Key Advantages of Government-Controlled Digital Currencies:

- Stability: CBDCs are backed by the central bank and are less likely to experience significant price fluctuations.

- Control: Governments can use CBDCs to implement monetary policy, manage inflation, and track economic activity.

- Efficiency: CBDCs can reduce the costs associated with processing and settling payments.

- Financial Inclusion: CBDCs can provide access to financial services for individuals and businesses that are currently unbanked or underbanked.

Challenges and Limitations:

- Privacy Concerns: Governments may have access to detailed transaction data, raising concerns about privacy and surveillance.

- Technological Risks: Implementing and maintaining a CBDC system requires significant technological infrastructure and expertise.

- Interoperability: Ensuring compatibility between different CBDC systems can be challenging.

- Economic Impact: The introduction of a CBDC could have unintended consequences for the financial system and the economy as a whole.

The Debate: Blockchain Cryptocurrency vs. Government-Controlled Currency

The debate between blockchain cryptocurrencies and government-controlled digital currencies is complex and multifaceted. While blockchain cryptocurrencies offer the promise of decentralization, security, and financial inclusion, they also face challenges related to volatility, scalability, and regulatory uncertainty. Government-controlled digital currencies, on the other hand, provide stability, control, and efficiency, but raise concerns about privacy, technological risks, and economic impact.

Ultimately, the optimal approach may involve a combination of both blockchain-based and government-controlled digital currencies. Blockchain technology can be used to enhance the efficiency and security of financial transactions, while government-controlled digital currencies can provide a stable and reliable medium of exchange.